Do you love your wife and children?

I know you will say, what an absurd question? Who doesn’t love his wife and children? But I am sure you are telling a big lie not only to me but constantly to yourself too. If you really love them and want to leave this world giving them no trouble and arranging to pass own your assets and liabilities without any hassle, have you penned down your will? If not why, where is your claim of love and care for them? Don’t you know how harsh this world is going to become for them, without you and especially if you are leaving wealth for them.

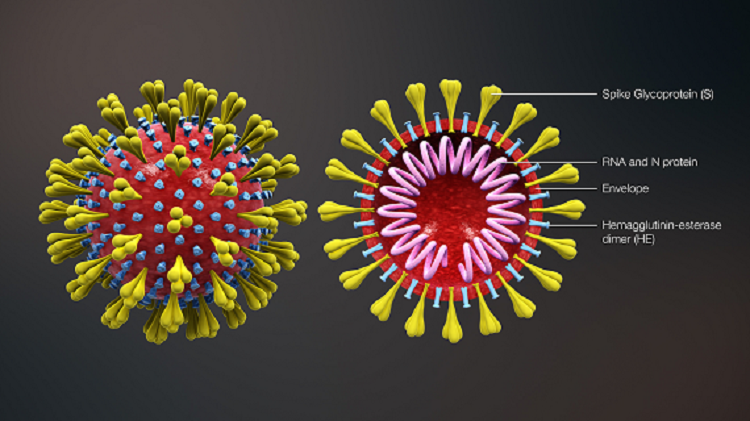

The factual situation today is, Covid has made our life very uncertain, with new Hindu Succession Act, 2005, daughters have got equal rights in property, so things are not that simple. Son-in-Laws, may force your daughter to ask for her share in parental property, so to avoid such complexities, it is better to write you Will on time.

Recent data show that nearly 66 per cent of the civil cases being fought in 170 district courts across the country were over land and property matters, with as many as 52.7 per cent cases being fought only among families.

To avoid this, it is highly recommended to write a Will on time, while taking proper care and covering all aspects of litigation, if any in future. The writing of a will in itself is very simple task and it can be done on a plain piece of paper; it is desirable to do it under proper legal supervision. Weather you are going to write your own will or going to take some legal help, we recommend you to ensure the followings to eliminate mistakes and minimize the chances of disputes.

1 Not having a Will

THIS IS PROBABLY THE biggest mistake. There is no age prescribed for drawing your will we suggest to do it as soon as possible. The thumb rule, is 50 years or earlier if you have multiple assets and properties. One of my close relatives died of heart attack just at the age of 55 and he didn’t leave a will. Since he had failed to appoint a nominee for any of the bank accounts, investments or properties, we had to spend a large amount of time and money fighting for our own money, said 23-year-old girl Nina, who approached me for legal help, a few years ago. The family ended up spending nearly two years and Rs 16 lakh to claim their property due to the absence of a will and nominations.

Apart from this, without a Will, the assets will be distributed as per the provisions of the Succession Act as per the religion. For instance, Hindus, Buddhists, Jains and Sikhs are governed by the Hindu Succession Act, 1956, and Hindu Succession (Amendment) Act 2005, which you may or may not have desired.

2 Drafting the Will incorrectly

You can draft the will either on your own,or through a lawyer. The important thing is to get it right. If any of the details are not precise or you get them wrong the Will can be easily contested in court. Get it done in the presence of two witnesses and must ensure that all the details entered are precise and correct. The most important aspect of the Will is valid signature of the person making it. Since a will can be written on a blank paper, the signature is the only authentic detail in it.

Equally important are three declarations, revocation, sound mental health and drawing the Will under no pressure, coercion, threat or influence.

One can even register the Will, with the concerned registrar. Registering the Will, minimizes the grounds on which a will can be challenged.

The other points one needs to ensure are (3) To be detailed and Specific (4) Keep Updating your Will (5) Appointing the right executor (6) Passing on assets to minor children. (7) Gifting assets during one’s lifetime (8) Not planning for disability or terminal illness.

Finally, if you are suffering from a terminal or debilitating illness, you can pen down a Living Will. As per recent Supreme Court ruling, you can list in advance, through a living will, the particular line of treatment or withdrawal of treatment, if you so want.

Let me conclude the importance of drawing a proper Will on time by giving the example of Vijaypat Singhania, the rounder of Raymond Company, who gifted all his shares, worth nearly Rs 1,000 crore, to his son, Gautam, and the 78-year old is now suffering financially.

Your free access to Supreme Law News has expired

Delhi, Mumbai & Dubai

Tel: M- 91- 9818320572. Email: editor.kumar@gmail.com

Website:

www.supremelawnews.com

www.ajaykr.com, www.4Csupremelawint.com

Facebook: /4Clawfirm, /legalajay Linkedin: /ajaykumarpandey1 Twitter: /editorkumar / YouTube: c/4cSupremeLaw Insta: /editor.kumarg

Telegram Channel

Whatsup Channel