Did you like my article? Like me on Facebook to see more articles like this in your feed.

( LLM, MBA, (UK), PhD, AIMA, AFAI, PHD Chamber, ICTC, PCI, FCC, DFC, PPL, MNP, BNI, ICJ (UK), WP, (UK), MLE, Harvard Square, London, CT, Blair Singer Institute, (USA), WILL, Dip. in International Crime, Leiden University, the Netherlands )

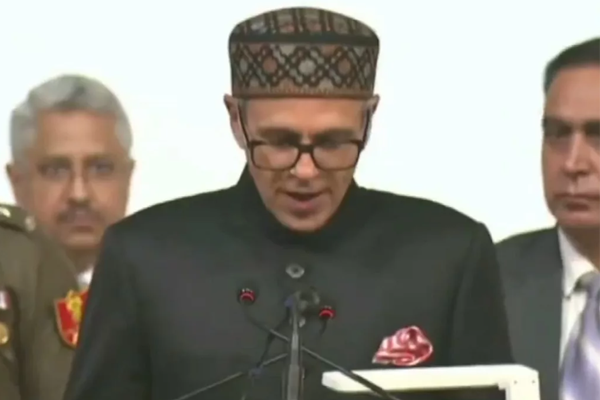

President, Supreme Court Life Member Bar Association

Advocate & Consultant, Supreme Court of India & High Courts

4CSupreme Law International, Delhi, NCR. Mumbai & Dubai

Director, International Council of Jurist, London

Member, World Independent Lawyers League (WILL)

Veteran Journalist

National General Secretary & Spokesperson, Lok Janshakti Party (Ram Vilas), NDA Govt led by PM Modi.

Tel: M- 91- 9818320572. Website: www.4Csupremelawint.com, www.drajaypandey.com. News: www.supremelawnews.com

615, Indra Parkash Building, 21, Barakhamba Road, Connaught Place, New Delhi-110011

236, New Lawyers Chamber, Supreme Court of India, New Delhi-110011

Panel Lawyer for Dr. Bhim Rao Ambedkar National Law University, Sonipat, Haryana, @Supreme Court, Punjab National Bank, Small Industrial Development Bank, (SIDBI), Central Bank and Energy Efficiency Services Ltd, GOI.

Trending around the web:

If You Want a Mercedes in 6 Months, Join Bollywood — Not the Bar": A Brutal Reality Check Every Young Lawyer Needs

Criminal Law Isn’t Just Practice—It’s War: Confessions of a Supreme Court Advocate Who Can't Quit the Battlefield

If You Want a Mercedes in 6 Months, Join Bollywood — Not the Bar": A Brutal Reality Check Every Young Lawyer Needs